Strong demand for safe investments supports gold price

Since the beginning of the year, gold has benefited from its status as a safe asset class. "Low to negative yields on government bonds and unprecedented fiscal and monetary policy stimuli create a high need for security among investors," explained Hans-Günter Ritter, Head of Precious Metals Trading at Heraeus. However, the record prices for gold and the economic distortions in the wake of the Corona pandemic are placing an extreme burden on consumer demand. Mine production is also likely to decline slightly this year due to Covid-19.

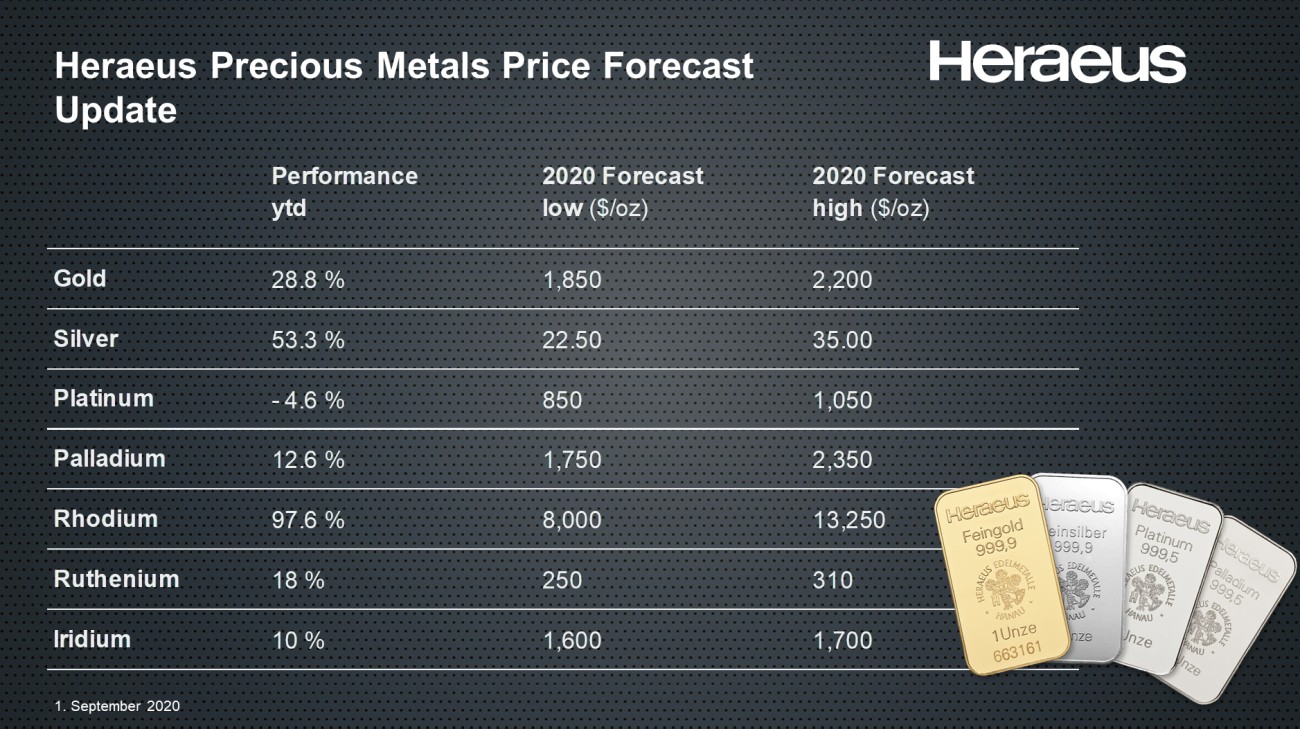

Strong investor demand is supporting the gold price despite weak consumer demand. Although political and economic uncertainties have already been largely priced in, the price of gold is likely to remain low. "However, the pandemic is far from over - and if the economic situation continues to deteriorate, the central banks could ease their monetary policy even further," said Ritter. The Heraeus experts expect a range of between 1850 and 2200 dollars per troy ounce of gold for the remaining period until the end of 2020.

Silver price remains at high level

The rapid rise in silver prices in July underscores the rekindled interest of investors for whom gold may already have been too expensive. HPM experts expect a further decline in global silver production, which will be exacerbated by production interruptions in key countries, particularly in South and Central America. Even if industrial demand recovers, silver will only continue to perform better than gold if investor demand remains high. For silver, Heraeus expects a range of between USD 22.50 and 35.00 per troy ounce in the remaining months of 2020.

Platinum holds its own despite market surplus

For platinum, which is used primarily in diesel exhaust catalysts, Heraeus expects a surplus of more than 1 million ounces or 31.1 tons this year (excl. investment demand), although production forecasts have been lowered as a result of the pandemic. The weaker automotive and jewelry industries are triggering a significant decline in overall demand. In addition, the effects of Covid-19 are leading to a drop in production in many chemical plants and the sluggish capacity build-up in China is likely to reduce the demand for platinum catalysts. The fundamental outlook remains weak, apart from investment demand. Heraeus sees a price range for platinum of $850 to $1050 per troy ounce.

Palladium supply not so strongly affected by corona

For the first time since 2009, Heraeus expects the palladium market to be balanced this year. Supply was less affected by the pandemic than demand, which brings the market closer to equilibrium. Due to the remote location of the Nornickel mines, Russian palladium production will remain largely unaffected this year.

At the same time, China, the largest market for gasoline vehicles, appears to be recovering. Palladium demand comes mainly from the automotive industry, which is the strongest consumer with 81 percent - the metal is used in exhaust catalytic converters for gasoline engines. As stricter emission standards come into force in many countries around the world, part of the drop in demand is likely to be offset by higher PGM loads in exhaust catalysts. On the other hand, demand from the chemical industry is likely to decline. According to Heraeus, the range for the fine ounce of palladium is between 1750 and 2350 dollars.

Rhodium still characterized by scarcity

Despite the drop in demand from Corona, the deficit in the rhodium market is expected to continue this year as supply has also been affected. Rhodium supply is likely to be more affected than platinum or palladium. Rhodium production is more concentrated in South Africa (81%), which is the mining region most affected by the pandemic. Rhodium should also benefit from the rapid recovery of the Chinese automobile market. The trading range this year is between $8000 and $13,250 per troy ounce.